How much life insurance is enough?

Only a little more than half (54%) of the US population had life insurance policies in place in 2020, according to a recent study by Statista, a consumer data research provider. Another study found that among those who had life insurance, about 20 percent felt that they did not have enough. Still others overestimated the cost of insurance. Millennials, in particular, overestimated the cost by five times the actual amount (source: LIMRA’s 2018 Insurance Barometer Study).

Scared it will be too expensive or not do any good, some people wonder whether they even need life insurance. To determine that, start by answering these questions: Do you have children, plan to have children, or have someone else who depends on you financially? Examples might include a spouse, disabled adult child or sibling, or grandchildren. Would your family be able to pay the bills and carry on normally (at least financially) if your income were suddenly no longer part of the picture?

If you answered yes to one or both these questions, you need life insurance. Working with me as your insurance agent, we can find the right type of life insurance to protect your family. Your agent will also help you find a policy that is affordable.

Make Sure You Have Enough Life Insurance

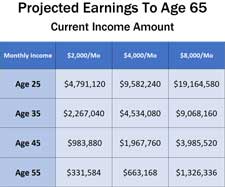

How much life insurance do you need? If you already have a policy, check it to make sure you have enough coverage. Remember, your family or other dependents will need to go on without you and your income, potentially for many years.

Several factors will help you decide how much you need; contact me for more advice. But you can begin by considering all your monthly expenses. Next, what future expenses do you anticipate, such as college for your children. Then, look at all your assets and income sources. Once you have accounted for all your sources of income minus all your expenses, you will arrive at your answer.

If this all sounds daunting, try a life insurance calculator ; here is one from Life Happens an industry company. http://www.lifehappens.org/insurance-overview/life-insurance/calculate-your-needs/. Answering the calculator’s questions will help you provide the relevant information. It will then do the math for you and give you a basic idea of how large your policy should be.

The calculator will weigh factors including your income, whether you have children, or a mortgage, student loans or other debt, as well as how much income your family needs per month (utilities, food, transportation costs, and extra expenses such as vacation). You will also be asked about potential future expenses and to estimate how many years your family will need the income.

Think It Through and Then Decide

As you decide how much life insurance to have, you should also consider who else in the family supplements or reduces drain on the family income. For example, if you are married and have children or other dependents, it is important to think through the possible financial consequences of the death of one spouse. Consider the ways in which each spouse contributes to the overall economic health of the family.

You may be focusing on the importance of a life insurance policy for the main income earner. However, even if the other parent is not employed or works part time, do not underestimate the value of that parent’s overall contributions to the family. He or she may provide key caregiving and household-management functions. If that spouse were to pass away, how much would it cost to provide childcare and other services to support the family? The amount of money the family saves in childcare expenses alone can be worth having a policy for the caregiving-focused parent as well as the parent providing the main income.

Life insurance decisions can be confusing. But no matter how daunting the process may seem, help is available. Engage your spouse or other loved ones, consult a financial planner, and then contact your Bradish agent to help you find the right policy for your needs, at an affordable price. The actions you take today will impact your family’s comfort and support in the future.

You, disabled? What are your chances of not being able to earn an income?

Higher than you probably think. You can ignore the problem, but it’s hard to ignore the facts:

- Just over 1 in 4 of today’s 20-year-olds will become disabled before they retire.

- Accidents are NOT usually the culprit. Back injuries, cancer, heart disease and other illnesses cause the majority of long-term absences.

Probably not. If you’re like most Americans, you don’t have disability insurance. Or enough emergency savings to last 34.6 months. Yes, that’s the duration of the average long-term disability claim. And don’t assume that you have adequate coverage through work. Most employer sponsored policies have provisions that reduce benefits if you are eligible to receive Social Security, workers compensation and/or other state programs. Insurer can offset benefits as long as you are eligible for benefits, not if you actually receive them.

If you become disabled, will you be ready? Or will you and your loved ones face serious financial hardship, possibly foreclosure and even bankruptcy? I can help you prepare for disability the same way you plan for other emergencies. Here’s how – Give me a call.